EGAIN (EGAN)·Q2 2026 Earnings Summary

eGain Stock Falls 7.5% Despite Strong EPS Beat as Q3 Guidance Disappoints

February 3, 2026 · by Fintool AI Agent

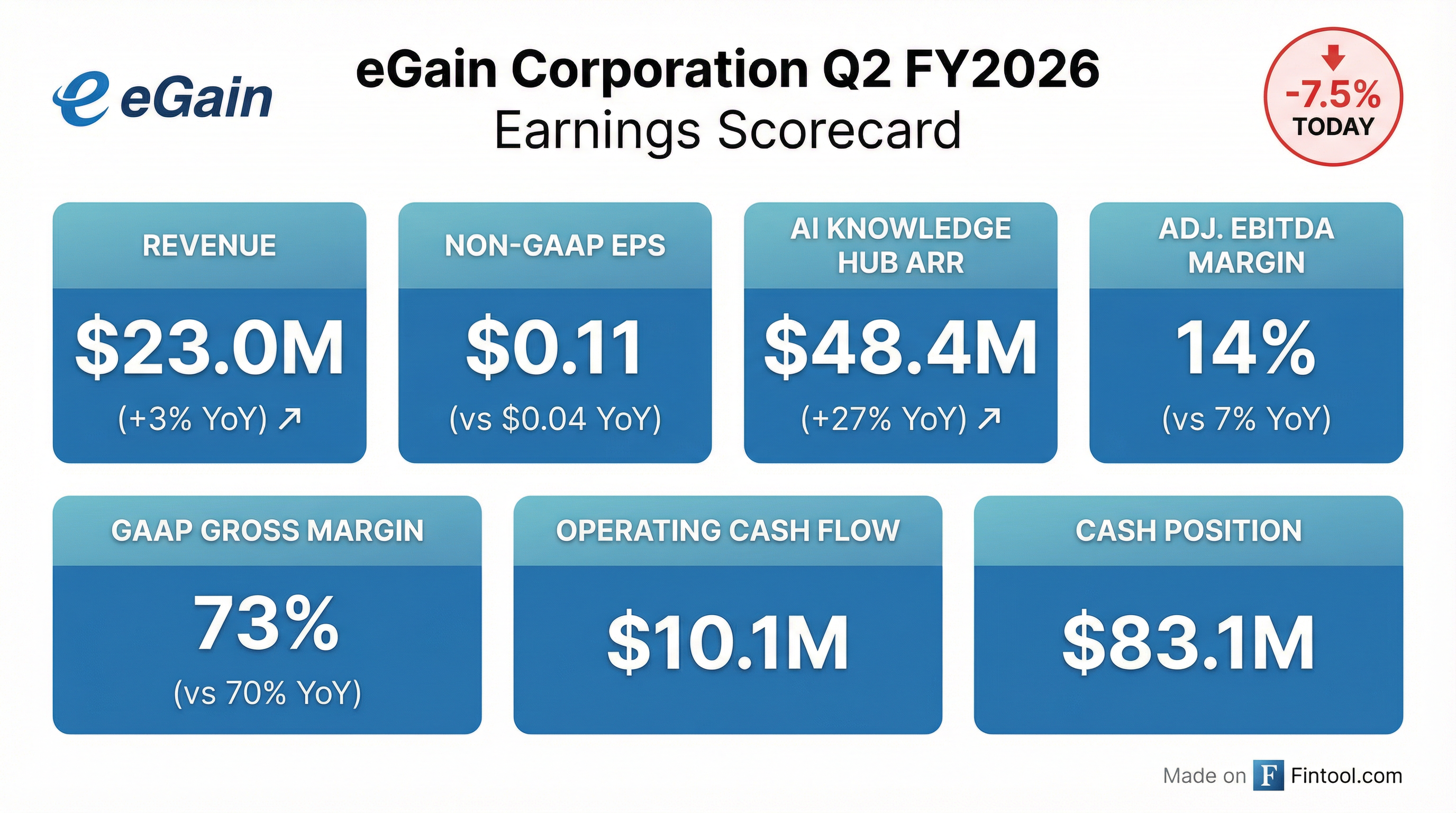

eGain Corporation (NASDAQ: EGAN) reported Q2 FY2026 results today with a solid earnings beat but disappointed investors with softer Q3 guidance. Despite Non-GAAP EPS of $0.11 beating expectations and AI Knowledge Hub ARR accelerating 27% YoY, the stock fell 7.5% to $9.56 as Q3 revenue guidance came in below the just-completed quarter.

Did eGain Beat Earnings?

EPS: Beat | Revenue: Slight Miss

eGain delivered a strong profitability beat while revenue came in roughly in-line with expectations:

The earnings improvement was substantial — Non-GAAP net income more than doubled to $3.0 million from $1.3 million in the year-ago quarter. Adjusted EBITDA margin expanded from 7% to 14%, reflecting strong operating leverage.

What Changed From Last Quarter?

The headline story is AI Knowledge Hub momentum. The flagship product now represents 64% of total SaaS ARR, up from approximately 53% a year ago, and grew 27% YoY to $48.4 million in ARR.

Key wins this quarter:

- Major Global Software Provider — Won enterprise knowledge mandate for "one of the largest business software providers in the world" with deployment across 100,000+ users and multiple use cases (CX, employee experience, AI experience). This presents an opportunity to potentially offer the solution to their global clients.

- US Kitchen Cabinet Manufacturer — Large manufacturer with 15+ brands and 6,000 employees selected AI Knowledge Hub to centralize scattered product and policy knowledge for long-tail product service questions.

- Achmea — One of Europe's largest insurance and financial services groups (10M+ customers) selected eGain to power 21,000 users across contact center and enterprise use cases as part of their digital insurer transformation.

- Oregon Community Credit Union — 250,000-member credit union selected eGain for enterprise use cases integrated with Genesys CCaaS platform.

Partner momentum accelerating:

- 25% of new logos in H1 FY2026 were partner-sourced — more than doubling YoY

- Partner-sourced leads increased 80% YoY in H1 FY2026

- Key partner channels: boutique knowledge consulting shops and TSD contact center networks

Inbound demand strengthening:

- 50%+ YoY increase in top-of-funnel AI knowledge leads

- 23% increase in pure inbound interest YoY

Margin expansion story:

*Values retrieved from S&P Global

The company has been consistently expanding margins while growing AI Knowledge Hub ARR at a high-20s rate.

What Did Management Guide?

Q3 FY2026 Guidance (for quarter ending March 31, 2026):

Note: Q3 has fewer calendar days, which CFO Eric Smith noted has an ~$800K revenue impact.

Full Year FY2026 Guidance (updated):

The guidance implies a weaker second half relative to the first. First half revenue totaled $46.5 million, meaning the second half is guided to $44.0M-$45.5M.

Non-core messaging sunset: 50% of non-core messaging revenue was reduced in Q2, with the balance sunsetting in Q1 FY2027. Excluding messaging products, SaaS revenue grew 8% YoY and total revenue grew 5% YoY.

PS margin recovery: Professional services had a negative margin in Q2 due to late-quarter bookings timing and government shutdown impact. The PS organization was right-sized in Q2, and margins expected to return to flat to slightly positive in Q3.

How Did the Stock React?

eGain shares fell 7.5% to $9.56 on the earnings release, giving back gains from recent sessions. Key context:

Why the selloff despite the EPS beat?

- Soft Q3 guidance — Revenue guided down sequentially despite AI momentum

- Second-half deceleration — H2 revenue ~$44-45M vs H1's $46.5M implies slowing growth

- High expectations — Stock had rallied from ~$4 lows in early 2025, pricing in continued acceleration

Key KPIs to Watch

SaaS Health Metrics:

The AI Knowledge Hub continues to drive the business with strong net retention improvement (116% vs 99% a year ago) — a critical SaaS metric indicating customers are expanding usage. The total RPO of $84.9M (+15% YoY) provides visibility into future revenue. Professional services revenue is declining (-23% YoY), but this is a strategic shift toward higher-margin SaaS as customers move to self-service implementations.

What Did the CEO Say?

"We are seeing the market converging, centered around CX and customer service, but extending beyond that to cover the entire enterprise for a centralized knowledge foundation that businesses are looking to create, which will then give them the right capability to springboard off for their AI initiatives."

— Ashu Roy, CEO

Key theme: CX-to-Enterprise expansion. A big majority of deals now start in customer experience and, in the first purchase itself, end up including enterprise use cases. Management sees this convergence as validation that a trusted knowledge foundation accelerates enterprise AI ROI.

Hiring strategy:

- Investing in high-end engineering and AI talent locally in the Bay Area

- New marketing head brought in with increased activity and investment planned for H2

- Sales motions shifting to expert-led, specialist-led approaches focused on the Composer proposition

Q&A Highlights

On the major software provider win (Jeff Van Rhee, Craig-Hallum):

"It was a fairly long sales cycle. We've been at it for, I would say, seriously, for about a year and a half... They didn't have an enterprise-wide knowledge platform up until then, but they did have other competitors for AI search in some of their dysfunctional groups." — Ashu Roy, CEO

On JPMorgan deployment status (Erik Suppiger, B. Riley):

"We are not fully rolled out as planned. We are halfway there, and we expect to be fully rolled out later this year as planned." — Ashu Roy, CEO

What eGain is displacing in competitive wins:

- SharePoint repositories with failed RAG implementations — customers "just run out of gas trying to make it work"

- Salesforce knowledge solutions — customers "run out of patience waiting for Salesforce to deliver"

- Legacy point knowledge management solutions that haven't kept pace with AI expectations

On AI/vibe coding competition (Richard Baldry, ROTH MKM):

"The barriers are definitely coming down for everyone... The focus and the use case understanding and the ability to put things together that have proven track record are going to be the differentiators." — Ashu Roy, CEO

On cash deployment priorities: Management outlined three priorities: (1) internal investment in AI product innovation, (2) continued share buyback program ($19.7M remaining), and (3) opportunistic M&A evaluation.

Capital Allocation & Balance Sheet

eGain continues to generate strong cash flow and build its balance sheet:

The company is debt-free with nearly $83 million in cash — significant for a ~$90M revenue business. The strong cash conversion (44% margin) provides flexibility for potential M&A or continued share repurchases. Treasury stock increased from $38.8M to $40.3M during the half, suggesting ongoing buybacks.

Product & Industry Recognition

eGain Composer Launch: Announced in October 2025 at the Chicago customer event, eGain Composer is a developer-focused offering that provides modular capabilities on the composable platform to build trusted AI solutions. It's driving engagement from enterprise AI groups and smaller partners building bespoke AI solutions.

Industry Recognition:

- Named a Leader in Gartner's Magic Quadrant for Generative AI Knowledge Apps

- Won KMWorld's Leaders Choice Award (November 2025)

Upcoming Events:

- eGain Solve customer event in London on May 6-7, 2026 (moved up from June) — new products and capabilities expected

- Oppenheimer Emerging Growth Conference (February 4, 2026)

- Roth Conference (March 23, 2026)

Risks and Concerns

-

Decelerating top-line growth — 3% YoY revenue growth is modest for a company with a "AI" growth story; investors may question the durability of Knowledge Hub momentum

-

Professional services decline — While strategically intentional, the -23% drop in services revenue creates near-term headwinds to total growth

-

Second-half guidance implies deceleration — H2 revenue guided ~$44-45M vs H1's $46.5M; management needs to explain why

-

Small customer base concentration — The company relies on a "relatively small number of customers for a substantial portion of revenue" per risk disclosures

-

Competition from AI giants — Generative AI advancements may attract larger competitors to the knowledge management space

Forward Catalysts

The Bottom Line

eGain delivered a strong profitability beat with margins expanding significantly (EBITDA margin doubled to 14%) and AI Knowledge Hub ARR accelerating to 27% growth. However, the stock sold off 7.5% as investors focused on soft Q3 guidance and implied second-half deceleration.

For bulls, the margin expansion story is real — the company is becoming more profitable as it shifts to higher-margin SaaS. For bears, 3% revenue growth and declining guidance raise questions about demand sustainability despite the "AI" branding.

Key question for next quarter: Can eGain accelerate top-line growth while maintaining margin expansion, or is this a margin story masking slowing demand?

Data sourced from eGain 8-K filed February 3, 2026, company earnings call slides, company earnings press release, and S&P Global.